Saving money can seem like a challenging task at times, especially in 2022, but trust me it’s worth it in the long run. The pandemic alone left so many people jobless and under severe financial hardship. But even if the pandemic didn’t cause you financial strain, hopefully, it taught you the importance of saving for a rainy day. Now I know you are probably thinking, “How am I going to save $10K in one year?” Well, it’s actually not as difficult as you may think. It just requires discipline, budgeting and eliminating the spending of any unnecessary purchases wherever you can.

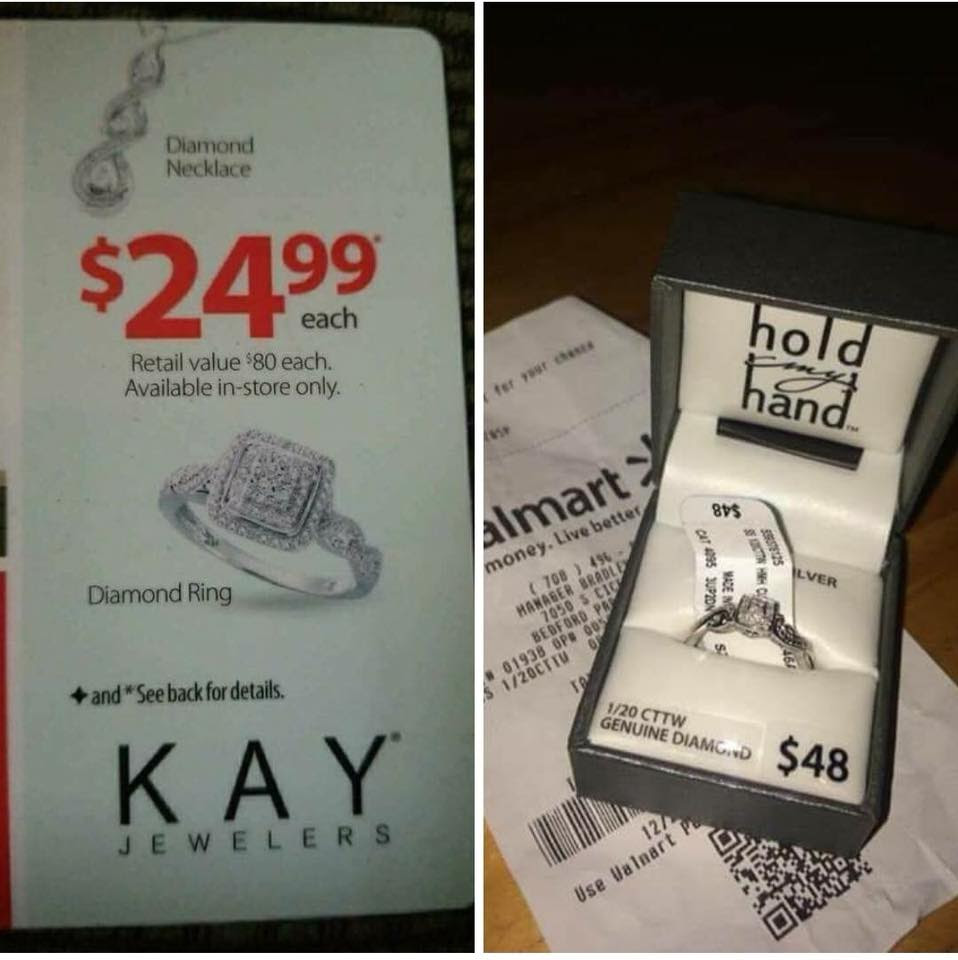

Take for example this beauty right here…

If you aren’t familiar, this picture went viral five years ago, sparking debates regarding if a woman should accept an engagement ring that costs $24 or $48. Some people believed it was too cheap and others argued the price shouldn’t matter. The thought of spending your life with the person you are madly in love with should be all that matters in the end.

While most people took very interesting stands, my financial mind couldn’t help but think that one of the leading causes of debt and financial stress is associated with the financial burden of overwhelming wedding costs amongst others. According to marketwatch.com, one-third of couples go into debt for their big day. While this information is alarming, a wedding is just one aspect of the difficult financial challenges many face on a daily basis. Let’s face it, life is EXPENSIVE! However, with some discipline and following these 4 easy tips below, you should be able to start the new year off right by saving and putting a few coins back in your pocket.

RELATED: 10 Ways to Avoid Living Paycheck to Paycheck

1. Pay yourself first.

Say it with me….” Pay Me First” and there you have it! This is one tip that many people fail to take full advantage of. I’ve encountered several clients, family members, and friends who solicit my financial advice fail to pay themselves first. The thought process behind this is they feel that hammering all of their incomes at their debt will help them pay it faster and thus achieve a life debt-free.

However, paying yourself first will ensure you always have an emergency savings when things get rocky. My personal recommendation is you put something away each pay period and watch it grow over time without interruption unless it’s a true emergency. 3-5% of your income is a great start, but anything really helps over time. It’s understandable that most may not have much disposable income, but putting away even $5 weekly can add up in the long run. You can never make too little or too much to start saving!

RELATED: The Basics of Planning for Your Retirement

2. Take advantage of employer matches to your retirement plan.

In this day and age, as an incentive for plan participation, most companies offer a percentage of money that they will match to encourage enrolling in retirement plan savings such as a 401(k). Again, you would be shocked at the number of people who don’t take advantage of this. I recommend individuals contribute to the plans match maximum which is sometimes 3-7%. By doing this, you’re no longer leaving free money on the table and saving money without practically doing anything but your regular job duties.

3. Take your lunch to work

This is one tip that has literally changed my life and my expenses! I live by cooking food at home and taking my lunch to work every day. If an average lunch costs $10 per day and making it at home only costs $5, you would potentially save