Yesterday, the House voted 217 to 213 to pass the GOP health-care law, designed to replace the Affordable Care Act (Obamacare) with what is called the American Health Care Act (AHCA) and it's already receiving (of course) mixed reviews.

Yesterday, the House voted 217 to 213 to pass the GOP health-care law, designed to replace the Affordable Care Act (Obamacare) with what is called the American Health Care Act (AHCA) and it's already receiving (of course) mixed reviews.

The Republicans at the press conference said that is was "great and awesome" while others outside, said differently,

While the head of Medicare said that it was a "great first step," the American Medical Association, which represents more than 200,000 doctors, whole-heartedly disagreed with the House’s passage of the American Health Care Act.

“The bill passed by the House today will result in millions of Americans losing access to quality, affordable health insurance and those with pre-existing health conditions face the possibility of going back to the time when insurers could charge them premiums that......made access to coverage out of the question,” the group said in a statement.

It added, however, that “action is needed to improve the current health care insurance system,” and it urged the Senate and White House to seek “bipartisan solutions.”

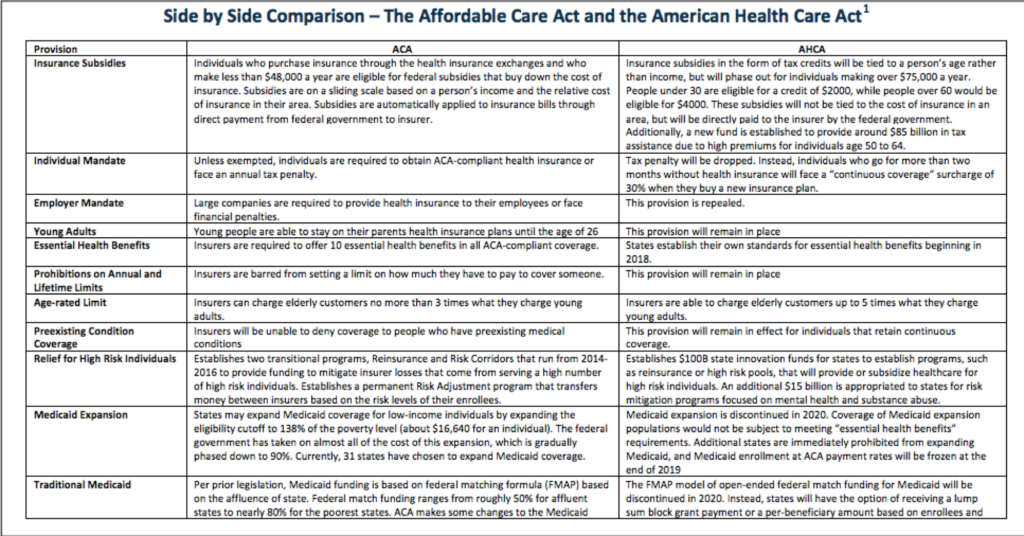

Here are some differences:

PREMIUMS

According the Kaiser Family Foundation, as of April 26, 2017, a draft amendment to the AHCA would allow states to waive certain consumer protections, including essential health benefits, community rating and age rating. If a state takes up such a waiver, the premium amounts for that state in this interactive would no longer be applicable. For example, enrollee costs could depend on their health status, with healthy people paying less and sicker people or those with pre-existing conditions paying more.

This analysis does not take into account changes the House made on March 20 that would potentially allow for larger tax credits under the AHCA for people over age 50; it is not yet clear whether and how those funds would be allocated to tax credits. The map also does not include cost-sharing assistance under the ACA that lowers deductibles and copayments for low-income marketplace enrollees.

For example, in 2016, people making between 100 – 150% of poverty enrolled in a silver plan on healthcare.gov received cost-sharing assistance worth $1,440; those with incomes between 150 – 200% of poverty received $1,068 on average; and those with......incomes between 200 – 250% of poverty received $144 on average.

Generally, people who are older, lower-income, or live in high-premium areas (like Alaska and Arizona) receive less financial assistance under the AHCA. Additionally, older people would have higher starting premiums under the AHCA and would therefore pay higher premiums.

Because younger people with higher-incomes and living in lower cost areas would receive more financial assistance and would have lower starting premiums on average, they would pay lower premiums on average.

Currently, most current Healthcare.gov enrollees have lower incomes:

About 66% of have incomes at or below250% of poverty (approximately $31,250 for a single individual in 2020), with the bulk (44% of all enrollees) having incomes at or below 150% of poverty (approximately $18,750 in 2020).

About 36% of enrollees are under age 35, 37% are age 35 to 54, and 27% are 55 or older.

Both the ACA and the American Health Care Act include tax credits in their approach. However, the law and the proposal calculate credit amounts differently: the ACA takes family income, local cost of insurance, and age into account, while the replacement proposal bases tax credits only on age, with a phase out for individuals with incomes above $75,000.

Here's a link to a side-by-side comparison of the ACA vs. AHCA and a snapshot below:

Here are some other standout differences:

HEALTH SAVINGS ACCOUNTS

Currently, Under the Affordable Care Act:

- Individuals must be enrolled in qualified high deductible health plan (HDHP) in order to make tax deductible contributions to an HSA

- Eligible individuals may contribute up to $3,350 annually (2016-2017) tax free, amount indexed annually to CPI. -

- Additional catch up contribution of up to $1,000 may be made by persons over age 55.Contribution limits doubled for enrollment in family coverage

- Amounts withdrawn for qualified medical expenses are not subject to income tax. Qualified medical expenses include amounts paid out-of-pocket for services subject to deductible or other cost sharing, and for other uncovered services, such as eyeglasses, dental care, or long term care. Nutritional supplements and health club fees are not qualified medical expenses. ACA also excluded over-the-counter drugs as a qualified expense.

Tax free HSA withdrawals cannot be used to pay for insurance premiums, with exception for COBRA premiums, health insurance premiums paid while receiving unemployment benefits, and long term care insurance premiums up to certain limits. Amounts withdrawn for any non-qualified expense are subject to income tax; in addition, before age 65 a 20% tax penalty applies for non-qualified distributions.

- Upon death of account holder, HSA can rollover tax free to an HSA of surviving spouse; for any non-spousal beneficiary, the account ceases to be a HSA and account balance becomes taxable to the beneficiary.

Under the American Health Care Act:

- Increase annual tax free contribution limit to equal the limit on out-of-pocket cost sharing under qualified high deductible health plans ($6,550 for self only coverage, $13,100 for family coverage in 2017, indexed for inflation).

- Additional catch up contribution of up to $1,000 may be made by persons over age 55. Both spouses can make catch up contributions to the same HSA.

- Amounts withdrawn for qualified medical expenses are not subject to income tax. Qualified medical expense definition expanded to include over-the-counter medications and expenses incurred up to 60 days prior to date HSA was established

- Tax penalty for HSA withdrawals used for non-qualified expenses is reduced from 20% to 10%.

WOMEN'S HEALTH

Currently, Under the AffordableCare Act:

- Require all plans offered in the individual and small group markets to cover ten categories of essential health benefits including maternity care and preventive care, such as contraception and cancer screenings.

- Prohibit preexisting conditions exclusions which historically have included pregnancy, prior C-section, and history of domestic violence.

- Prohibit discriminatory premium pricing based on gender (gender rating).

- Prohibit abortion coverage from being required. Federal premium and cost-sharing subsidies cannot pay for abortion beyond saving the life of the woman or in cases of rape or incest (Hyde amendment). If a subsidy-eligible individual enrolls in a plan that chooses to cover abortion services federal subsidy funds must be segregated from private premium payments or state funds.

- Prohibit plans from discriminating against any provider because of an unwillingness to provide, pay for, provide coverage of, or refer for abortions.

Under the American Health Care Act:

- ACA essential health benefit requirement for individual and small group health insurance policies is not changed, including requirement to cover maternity care as an essential health benefit; however, EHB can be changed under state waiver authority.

- Requirement for individual and group plans to cover preventive benefits, such as contraception and cancer screenings, with no cost sharing is not changed.

- Prohibition on gender rating is not changed

- Prohibition on pre-existing conditions exclusions, including for pregnancy, prior C-section, and history of domestic violence, is not changed.

- Prohibit federal Medicaid funding for Planned Parenthood clinics for one year, effective upon date of enactment. -

- Specifies that federal funds to states including those used by managed care organizations under state contract are prohibited from going to such entity.

- In states electing Medicaid block grant, family planning would no longer be a mandatory covered service.

- Redefine qualified health plan to exclude any plan that covers abortion services, beyond those for saving the life of the woman or in cases of rape or incest (Hyde amendment), effective in 2018

- Prohibit federal premium tax credits from being applied to plans that cover abortion services, beyond Hyde limitations. Disqualify small employers from receiving tax credits if their plans include abortion coverage beyond Hyde limitations, effective in 2018. Does not prevent an insurer from offering or an individual from buying separate policies to cover abortion as long as no tax credits are applied.

For more of a breakdown of the differences between the two plans, click here.